30 Essential Stats on In-App Purchases and Monetization

Published on July 28, 2016/Last edited on July 28, 2016/5 min read

Team Braze

Looking to make money from—or better monetize—your app via in-app purchases? To succeed in this multi-billion dollar business, which has grown by the tens of billions since the early in-app purchase days of 2011, you’ll need to win over a small but active segment of smart device owners.

Mobile commerce, which is more widely adopted across internet users than in-app purchasing, is projected to generate hundreds of billions of dollars in revenue within the next couple of years, but is still lagging behind offline and desktop spending.

What does the landscape look like for businesses wanting to push conversions in-app or on the mobile web? We’ve culled the latest industry reports and projections and put together these need-to-know stats on mobile consumers and their spending habits.

Download The In-App Messaging 101 Guide

In-app purchase statistics

1. Just over 5% of app users currently spend money on in-app purchases, according to a study of more than 100 million device owners across 1,000+ apps.

2. Yet how much money these customers spend is 20 times greater than the take companies earn from all other users (on paid app downloads) combined, according to research conducted by AppsFlyer.

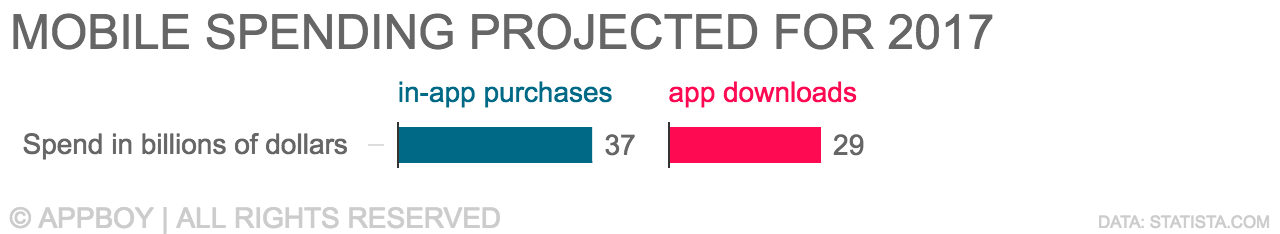

3. By 2017, the total of global sales from in-app purchases is projected to amount to nearly $37 billion.

4. In comparison, the total of global sales from paid app downloads is projected to amount to nearly $29 billion by 2017.

5. By 2017, in-app purchase revenue is set to be the number one source of mobile app revenue, accounting for 48.2% of earnings compared to 14% from ads-based revenue and 37.8% from paid app downloads.

6. As of 2016, Apple and Google hit a new milestone: Both stores have two million apps available for download.

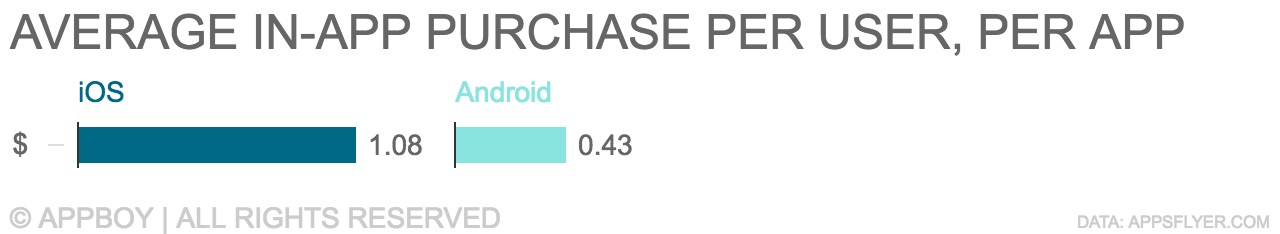

7. Which mobile device your audience owns makes a difference when it comes to how much they’re likely to spend. On average, iOS shoppers will spend 2.5 times more than Android users will on in-app purchases.

8. The average in-app purchase per user is $1.08 for iOS users and $0.43 for Android users, according to an AppsFlyer study.

9. Where in the world are people the most likely to spend the most in the apps? In Asia—where mobile spenders shell out 40% more per month than anywhere else in the globe, reports AppsFlyer.

10. North America comes in second on that list.

11. And while on average, North Americans spend less per month on their total expenditures than in-app purchasers in Asia, when it comes to a single in-app purchase they spend the highest amount.

12. The type of app that drives their bill up? North Americans outspend Europeans and Asians by 2.5 and 3 times in shopping apps.

13. Half of apps downloaded from the Google Play store are freemium, according to a “The State of Play: A look at the growth of Google Play,” from App Annie.

14. And these free apps with in-app purchases garner 98% of global Google Play revenue, according to App Annie.

15. For iOS, freemium apps generate a similar amount of overall revenue for the Apple App Store: 95% of global earnings.

16. Heaviest Google Play spenders can be found in Japan, followed by the U.S., South Korea, Germany, and the U.K.

17. Game apps generate the most Google Play revenue, accounting for 90% in Q1 of 2014.

To reach and spur action from this limited but potentially lucrative audience of paying users, you will need to understand your brand’s customer lifecycles, know how to keep the most active and loyal users engaged, and have strategies for re-engaging lapsing and inactive users. Here are some thought-starters:

- The Buy-In: 8 Ways to Drive That First In-App Purchase

- 5 Tips for Increasing In-App Conversions Up to 200% [Infographic]

- How Deep Linking Can Double Conversion, Increase Retention, and Boost Engagement

- In-App Subscriptions: Why Retention Is Even More Critical

Mobile commerce statistics

But apps are only part of the mobile purchasing story. The line between mobile apps and mobile web is vanishing and the majority of today’s ecommerce (browsing at, least) is happening on the mobile web. Mobile sales are only projected to grow. So what do you need to know to succeed?

18. Within the retail industry, ecommerce generated over $300 billion in sales for the first time in 2014.

19. By 2018, mobile commerce as a category within ecommerce is projected to generate nearly $205 billion in retail revenue.

20. Combined, mobile and desktop spending accounts for 15% of overall consumer spending, according to comScore.

21. Most of online shoppers—60%—are using mobile devices.

22. However, the majority of online purchases are not made on mobile devices: 84% of ecommerce sales still happen on desktop devices, reports comScore.

23. Mobile commerce accounts for $1 out of every $6 spent on ecommerce.

24. In 2015, while overall retail growth was up 1%, mobile commerce grew 56% from the previous year; desktop commerce grew by 8%.

25. The mobile commerce categories that generate the most money are video games and accessories, toys and hobbies, and sports and fitness.

26. During the 2015 holiday season, the two busiest days for ecommerce were Cyber Monday followed by Black Friday, with mobile traffic outpacing desktop both days.

27. Among the top 100 retail companies in the world, just 60% have mobile websites, putting the other 40% at the newbie mobile marketer stage.

28. The average ecommerce website takes 5.5 seconds to load on mobile devices, according to a Business Insider review.

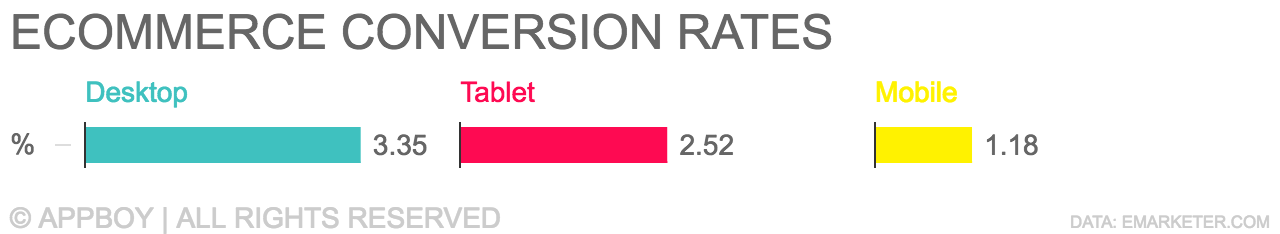

29. Ecommerce conversion rates are stronger on desktop (3.35%) and tablets (2.52%) than on mobile devices (1.18%).

30. Mobile conversion rates are increasing, though, growing 32.6% from 0.89% in 2014 to 1.18% in 2015.

What will truly set a company apart is attention to learning what makes customers unique, and using that intel to market across devices. You can learn what motivates your customers not just to browse or add items to their carts, but actually complete their transactions and keep coming back for more. With the right tools—from in-app messaging to web push and beyond—it’s all possible.

Here are some guides to get started:

- The Ultimate Guide to Mobile Engagement

- Maximize Your Promo Campaign With These 4 Channels

- Your Customers Are Telling You How To Reach Them—Listen

- What It Takes to Win Your Customer’s Loyalty