5 min read

MoneySuperMarket Implements Braze To Turbocharge Their Messaging

British price comparison service MoneySuperMarket was using a customer engagement platform that didn’t integrate with their architecture, making effective messaging costly and time-consuming. They also wanted to add new channels on web and mobile.

MoneySuperMarket turned to Braze, launching their first campaign in just 118 days after signing. Now, they are able to power hyper-relevant, cross-channel experiences to every customer, as data can move more freely across teams and platforms.

Their Car Incentive campaign, which involved vouchers linked to car insurance purchases, set a high engagement benchmark. For additional campaigns, connecting their content recommendation engine and data warehousing systems to Braze also allowed them to drive a 25% conversion rate and boost send rates from 500 to 25,000 a minute.

INDUSTRY

PRODUCTS USED

BY THE METRICS

8

Weeks from concept to live deployment

25,000

Emails sent per minute

Founded in 1993, British price comparison provider MoneySuperMarket has evolved over time, becoming a dominant financial service by constantly adapting their technology, which enables consumers to compare prices on a range of products, including energy, car insurance, home insurance, travel insurance, mortgages, credit cards, and loans.

While their data infrastructure has become a powerful force for the business, the brand’s previous messaging campaigns had been focused on weekly emails, which were relatively effective but time-consuming, with long lead times. With the massive amount of data their backend captured regarding user activities, MoneySuperMarket had a number of powerful levers to boost conversion and drive engagement. However, their messaging platform just wasn’t capable of quickly supporting those efforts, leading MoneySuperMarket to seek out a real-time solution, with the goal of unlocking better speed to market.

MoneySuperMarket wanted to engage more intuitively and productively with customers as they used their service, so they turned to Braze to ensure they had the infrastructure needed to power that sort of campaign.

Unbelievable Speed

Just 118 days after signing, MoneySuperMarket was able to launch their first campaign leveraging Braze. “Your Money Roundup,” an email newsletter, showed customers helpful reminders about upcoming policy renewals, promotions, and cross-sell opportunities. It was fully personalized via Braze Connected Content and MoneySuperMarket’s recommendation engine and required:

- Web and mobile SDKs

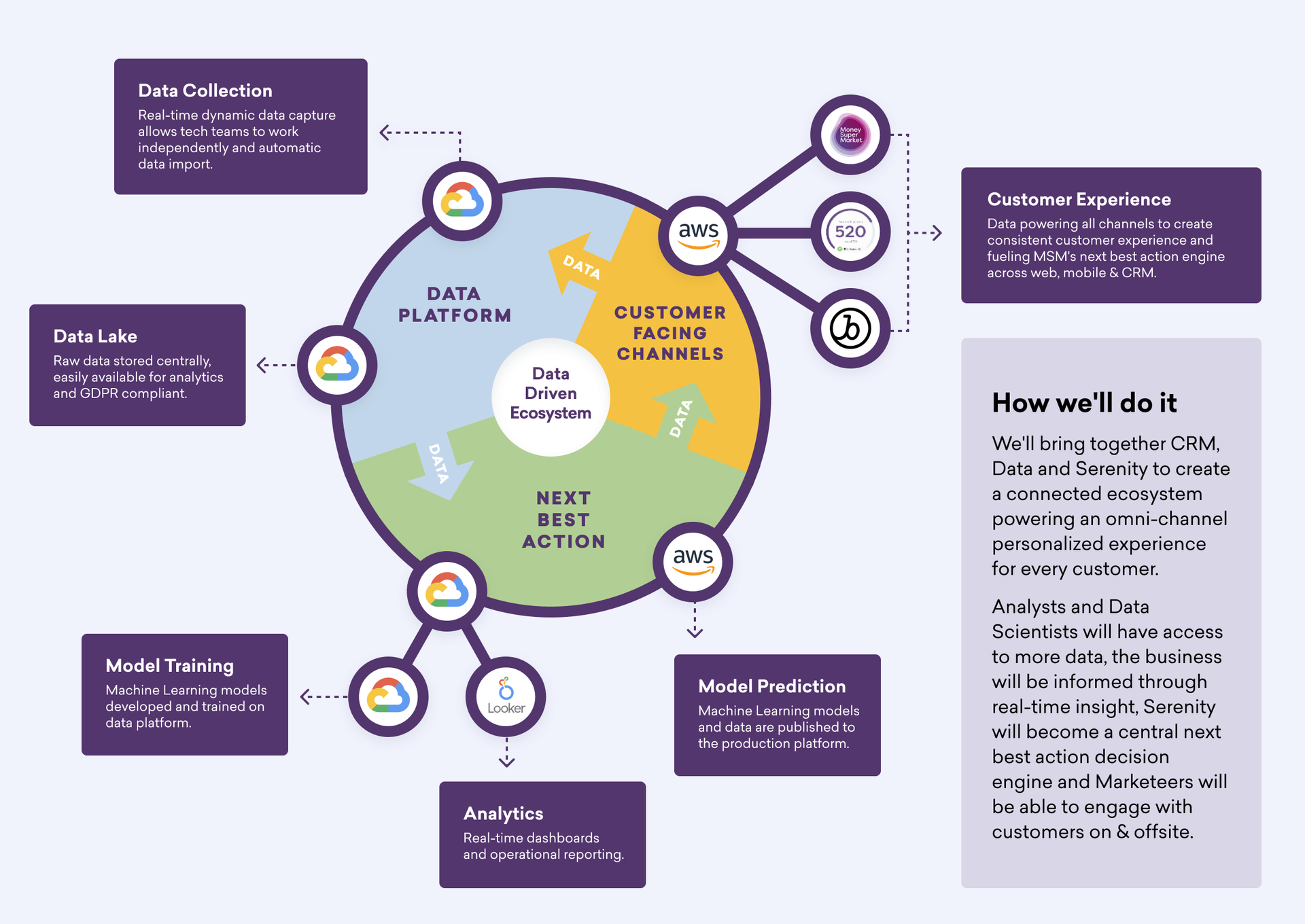

- API integration with their internal recommendation engine, Serenity

- API integration with data contained in Google Cloud Platform (GCP)

- Braze Currents data export

- Training their team on Liquid personalization

- Hardening and scaling Serenity infrastructure from 500 transitions per second (TPM) to 25k TPM

- Using the Braze platform’s throttling capability to ensure Connected Content calls operated within a safe limit to protect Serenity

The Braze platform’s Connected Content feature was a perfect fit for MoneySuperMarket’s needs. It allows any information that is accessible through the client’s API to be streamed into messaging in real time. Once Braze Connected Content is added within the body of the message, Braze can make a call to MoneySuperMarket’s internal recommendation engine API, which supplies personalized content for the emails milliseconds before the message is sent. From the point of view of MoneySuperMarket’s customers, this was a seamless process, as each element was visually identical with the company’s branding.

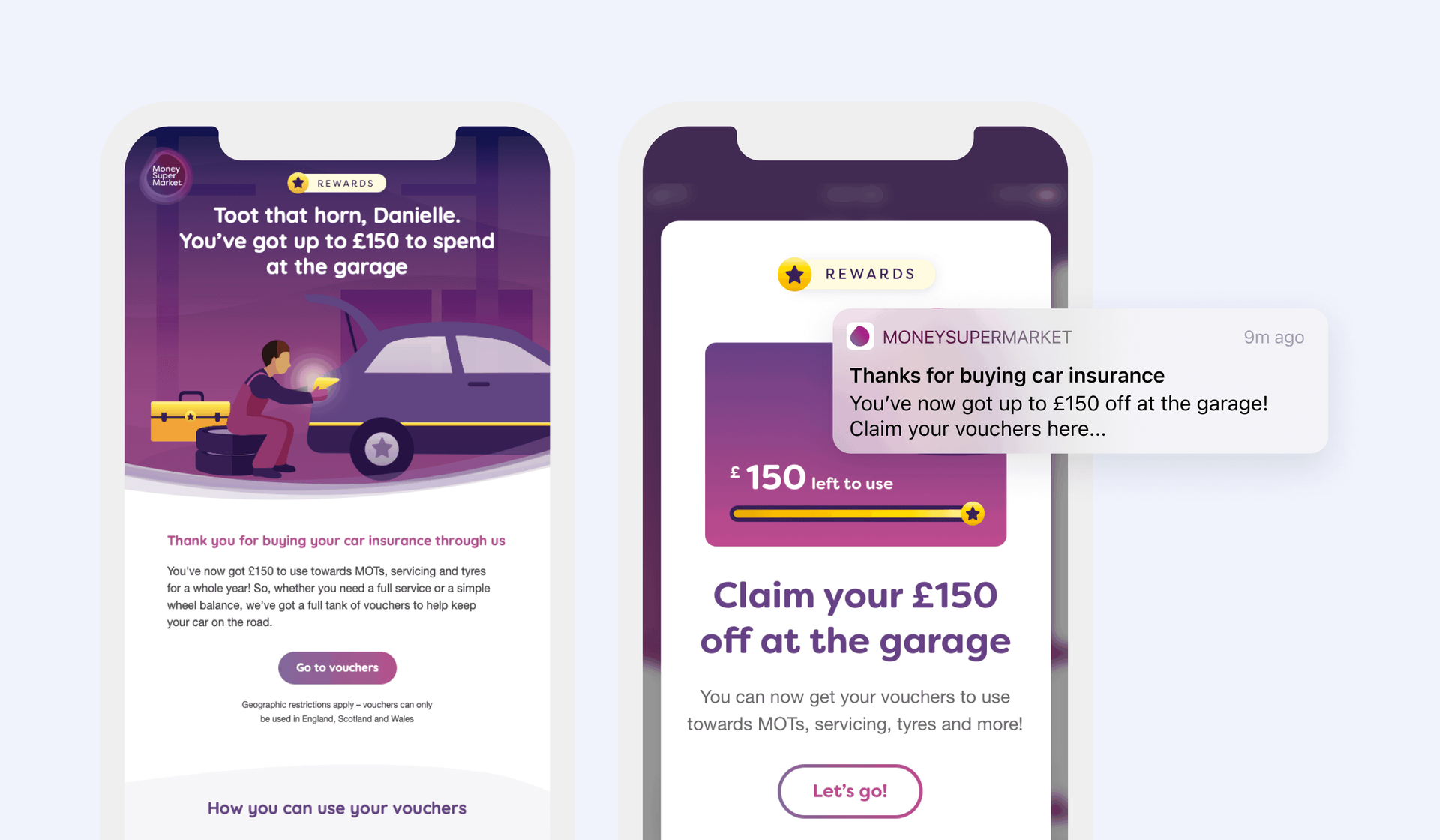

For the Car Incentive campaign, users who purchased an insurance policy were eligible for a 150 pound (GBP) reward for vehicle maintenance. Instead of sending a generic email to their entire customer base, they connected in real time through multiple channels in response to user actions. With the car incentive promotion, that involved a message being cued when the customer clicked to inform them of the incentive and pull them back into the system. When the purchase was made, a webhook was sent to a third-party solution to provide the voucher and then send back transactional data.

MoneySuperMarket’s customer profile system is stored in Google Cloud, which lets them aggregate data from multiple sources and assemble it into a single view that is usable throughout the company. That data is then fed into Braze from Google Cloud using the Braze platform’s User Track API, allowing MoneySuperMarket to create and manage audience segments and efficiently update 1.6 million customer profile updates per day. One of the key issues that MoneySuperMarket needed to address was data sprawl. Braze allowed them to bring all of that data into a single profile for each user, eliminating the need to join disparate sources of information every time they wanted to build a new messaging campaign.

In addition to email, their traditional messaging channel, Braze made it possible for MoneySuperMarket to work with in-app messaging and SMS to reach customers across multiple platforms. They also used customer data to power personalized messaging such as:

- Eligibility reminder emails sent to every customer who inquired about a policy and “clicked out” to a provider site

- Auto-confirmation emails sent to customers as soon as MoneySuperMarket received a sale notification from any provider, making it easier for customers to handle manual claims

- Notifications encouraging rewards hub users to activate access, sent via Braze webhooks

- Voucher communications like redemption codes, remaining balance, etc., sent in real time

MoneySuperMarket’s Results: Faster Delivery, Bigger Returns

Braze processed and delivered requests in real time. At the start of the campaign, they were sending 500 emails a minute. That rapidly grew to 25,000 per minute. Additionally, part of their learning was scaling up their recommendation engine to handle Braze Connected Content requests—using the Braze rate limiting feature to safely and effectively support that process, they went from 2,500 transactions per minute in May to 25,000 in June.

With the success of the car incentive promotion, MoneySuperMarket is conceptualizing new ways to use the Braze customer engagement platform to grow other verticals within their business. The possibilities are endless.

"Braze has given them the right tools to enable the business to grow at pace, and whereas before they were focussed predominantly on email, the ease that Braze brings to multi-channel means they can maximize the full customer journey," said Matthew Cresswell, Chief Data Architect at MoneySuperMarket

Final Thoughts

Real-time messaging is an incredibly powerful way to keep customers engaged throughout their journey. Having the ability to communicate offers and other information when users are most receptive makes their experience feel personal and valuable. MoneySuperMarket can now make the most of their rich data architecture to bring their clients the financial guidance they need no matter where they are.

For more on our approach to engagement, read the Braze guide on reaching customers in the moments that matter.